I often think of what novelist F. Scott Fitzgerald said decades ago: “The test of a first-rate...

Expense Management vs Spend Management

Introduction

Expensicon 2023 ended earlier this week. What an amazing event. The setting was a huge, beautiful “castle” set near the coast in Puglia, Italy. George Clooney was there and did a very candid – and very funny – discussion with David Barrett. But the best part of the entire show was what I was able to learn from the seminars, one-on-one meetings, and the other attendees. So I thought that you might benefit from what I gleaned at the event.

Part of my learning included updates on Expensify’s credit card offering, which you might want to consider when you are either choosing or using the Expensify product. If you use the card on at least a nominal level, the cash back can actually offset the cost of the software. That’s right. You will be able use one of my favorite accounting terms, “free.”

Another key learning was the difference between expense management software and spend management software. I get a lot of questions on this from my clients and so I thought I would create a LinkedIn article that explains the difference and why, ideally you should obtain a software product that does both.

That’s the subject of today’s article.

As always, if you have any questions about this subject matter or anything relating to finance and accounting, please reach out to me on LinkedIn or email me. Let’s chat about how we can help.

All my best,

Kim

Expense Management vs Spend Management

While expense management is a relative newcomer to the productivity app software world, spend management is yet even newer. What’s the difference between the two? Which one works best for you, in your current situation?

I’ll explain what each of these applications are and where they are best utilized, and will provide my recommendation. Read on!

Expense Management: Why and How?

Let’s start with expense management and specifically, automating expense reports. But first, let’s see what people really think about expense reports.

The result are in and, it’s official: Pretty much everyone hates doing expense reports.

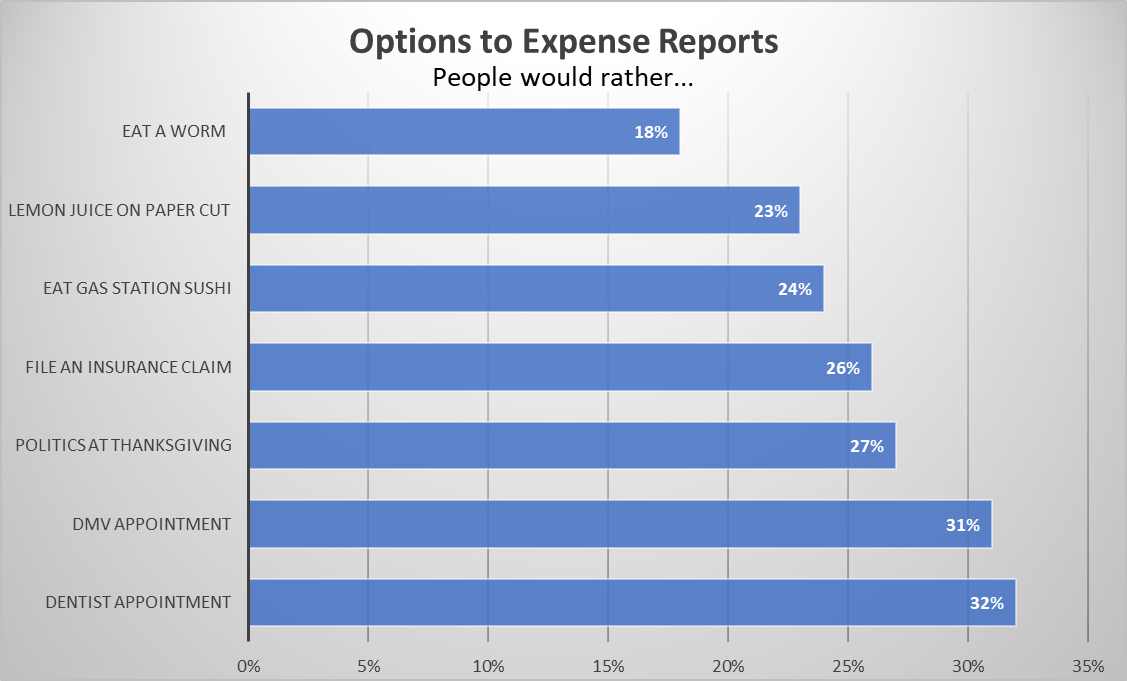

In a recent – and somewhat tongue-in-cheek – study, it was found that business travelers dislike filing expense reports so much that they would rather do some pretty bizarre things rather than file one. For example, nearly a third of travelers would rather go to the dentist (32%) and renew their driver’s licenses (31%). Over a quarter (27%) said that they would rather talk politics at the Thanksgiving table, while 26% said they would rather file an insurance claim.

Source: Business Travelers and Expense Reports

Source: Business Travelers and Expense Reports

Why do we hate doing expense reports?

The reasons that most of us dislike doing expense reports revolve around three key areas; first, it’s the hassle of dealing with all of the different types of receipts; second, it’s that you receive the receipts at different times and places; and third, that the receipts are in different formats, i.e., paper, PC, smartphone, etc., for your trip. This sort of three-headed monster effect can make a traveler’s life miserable. Here are examples:

- You booked your airline ticket a month in advance using the company credit card – that receipt is on your PC.

- You Uber’d from the airport to the hotel, using your personal credit card – that receipt is on your phone.

- You tipped the hotel bellman $5 cash for helping you with your bags – that receipt is, well, in your head.

- You drove to and from the airport and totally forgot to record the round-trip mileage.

More fun: Once you find all of these receipts, you have to fill out your expense report. And that’s a real drag.

Compounding this is that the accounting folks aren’t happy when you don’t fill out your reports in a timely manner as it can prevent them from accurately closing their books at month-end. Even worse, sometimes purchases aren’t approved, but you don’t know until after you have spent your money.

“If only there was an app for that…”

Well, there is an app for expense reports. In fact there are several. Some are better than others; but more on that later.

Since it, i.e., the expense management tool, only has one thing to do – vs the million things that you have to do – an expense management app is much better at keeping track of your receipts than your human brain. It will remember the tiny airport parking receipt that’s in your wallet and the hotel bill that you left, oh boy, back at the hotel, and everything in between.

And when you finally do get the receipts all together and carefully reconstruct the whirlwind trip that included a tradeshow, customer dinners, and a late, late night team bonding meeting (and maybe a hangover… oh wait, don’t mention that on your report…), there might be other issues. Like the mistakes that accounting finds on your report.

Hey, the accountants are just doing their job!

Here’s how expense management works.

When you pay for something, like a meal at a restaurant, you simply use the expense management software phone app to take a picture of the receipt; the app reads the receipt for you, documents and categorizes it, adds it, along with other relevant receipts all up very accurately, and then presents them in a nice clean, concise report. All you have to do is review it and sign it. Or, what the heck, just sign it already and trust the software!

The app relieves the stress of digging through your wallet, glove box, couch cushions, etc., to find your receipts.

A cool side benefit is that your expense report is done in real time; you don’t have to piece together your trip-end or month-end report, it’s done for you automatically. And you can set up rules so that any expenses under a certain dollar amount, e.g., $100, are automatically pre-approved, which also helps make your employee business traveler happy. Also, rules-based expense and spend management means the travelers know right away if their spending is compliant.

Bonus: Your company’s finance team will love expense management software because it integrates – or at least should integrate (don’t buy an app that doesn’t) – with your back-office/ERP system like QuickBooks or NetSuite. That makes their lives, especially when it comes to things like month-end closes, much easier.

Pro Tip: I use my expense management software to track my personal expenses, including vacations and other trips, in addition to using it for my business expenses. I find that having all of my receipts digitized and in a nice, concise format makes it easy to retrieve them if I need to dispute a charge, etc.

An option to Expense Management: Spend Management

Spend management software can be defined in a myriad of ways but for the purposes of this discussion, let’s focus on the travel and expense (commonly known as T&E) aspect of corporate spending. One way to think of it is this: while expense management works in a reactive mode, i.e., to reimburse the traveler for their expenses, spend management is more of a proactive, pre-approved way to fund expenses. To coin a phrase, you could call it “preimbursement.”

Because the approval workflow is built into the card when it is defined for the traveler, and that all expenses are pre-approved, your company can better control funds while protecting the finance team and employees from potential compliance violations.

Spend management tools usually include both the software app and a corporate card. This card is like a debit card, preloaded with funds. Think of it like a “rev limiter” for spending, where it keeps employees from overspending, while at the same time tracking business expenses. This also ensures that the expenses are accurate when it comes to financial statements. It also ensures that expenses are preapproved so there’s no awkward “Well, I thought that I could expense those snow tires for my car…” (true story) discussion with the accounting department.

And here’s a bonus: some spend management vendors offer a cash-back, like 2% – and sometimes even as high as 4% – or other incentive like Amazon gift cards for the employees. Note that while I think that the card’s a nice idea, to me I’d rather get “free” software (i.e., where the rebate pays for the subscription), than a gift card. 😊

Your Employees Want Options

In today’s world we all want our employees to be happy, to give them as much freedom as possible. And business travel should be no exception. Your employees want to be able to use their own credit card, whether it’s to garner points or just for convenience’s sake.

This is borne out by a recent study: When asked what accounts employees are using for expensed items on business trips, nearly half (48%) of respondents said they mix both personal and company credit cards. While over a quarter (27%) said they use their own card only, it’s unclear whether that is by choice or because the employees have no access to a company card. Fifty-three percent of business travelers admit to having accidentally put a personal charge on a corporate card, or vice versa.[i]

The reality is that if your company’s spend management software won’t allow your employees the flexibility to use their own personal credit card, you might have some unhappy employees. Imagine telling your top sales rep that they can’t use their own card and thereby won’t be able to use their points to take their family to Bora Bora for vacation. Personally speaking, I wouldn’t want to have that conversation.

Spend Management or Expense Management? My preference: Both.

There’s lots of confusion about expense management vs spend management. (One vendor describes expense management as “being like buying floppy drives.” What??) For me, here’s a simple definition and distinction between the two: expense management is more reactive and spend management is more proactive.

Expense Management or Spend Management – which should you choose? Fundamentally speaking, one lets employees use their own credit cards, automates the expense report process, and provide reimbursement, while the other gives the employee a credit card and then reconciles everything for them sort of like a debit card would.

Based on my experience of being on both sides, as a traveler and an accountant, which do I recommend?

I recommend using a software app that does both expense management and spend management!

What the…? Is that even possible?

Yes, it is, believe it or not. One company, Expensify, which pretty much invented the expense management market space, allows companies to have both expense and spend management in one software solution. That – and the fact that it’s super easy to use – is why I’ve been recommending it for years.

Here’s a list of reasons why I recommend Expensify:

- Utilizing one platform that has both systems gives your employees freedom. If they want or need to use their own card to make purchases, they can do so under the expense management side.

- Ease of use. The corporate card side of spend management lets employees make purchases without having to fill out expense reports. If it’s in budget, it will go through, hassle free.

- Having both tools mitigates mistakes for the traveler and the accounting department.

- Rules based approval processes can be set up to make some items, like expenses for under $100, preapproved, and route the report to the employee>supervisor>accounting>higher approver based on the dollar amount.

- Upon approval, funds go directly to the employee’s bank account. Travelers don’t have to wait for the approval cycle to get paid as expenses are approved in real-time as they are made.

- Pre-approved T&E – gives your finance team more control over spending.

- Real-time reconciliation of expenses – no waiting until the entire expense report has been submitted.

- Integrates with all major back-office systems like QuickBooks, NetSuite, etc.

- With its cash back feature, the Expensify app can actually pay for itself (i.e., pay for the program subscription) if they meet certain spend criteria.[ii] So Expensify could be free for you and your organization.

The Bottom Line:

Let’s face it, you want to help your employees be as successful as possible – especially when they’re on the road. And taking away the stress and drudgery of the expense management process is a huge first step. Travelling is already enough of a hassle, why not give your people an advantage by automating their expense reports? (BTW, did you know that travel and travail both come from the same root word?[iii] It seems very apropos in today’s travel environment.) I believe that Expensify can make your employees more successful, and possibly even help them close more deals or make more customers happy, etc., etc.

So if you, as a corporation, want to make your employees’ lives easier and give them a bit of freedom when they travel, while at the same time making your own life easier from a back-office perspective, I highly recommend Expensify.

Disclaimer: I am not an employee of any expense management or spend management software companies. I am, after over two decades of working with high-tech back-office software systems, somewhat of a subject matter expert on these types of things. And while I do recommend certain products because I like how they can help optimize a company’s accounting systems; my opinions remain my own.

[i] expense-reporting-business-travel

[ii] Please check with Expensify for the details on how to qualify.

[iii] https://en.wikipedia.org/wiki/Travel According to Simon Winchester in his book The Best Travelers' Tales (2004), the words travel and travail both share an even more ancient root: a Roman instrument of torture called the tripalium (in Latin it means "three stakes", as in to impale). This link may reflect the extreme difficulty of travel in ancient times.